Forex Trading

The Advantages of Contract for Difference Trading for Malaysian Business Professionals in Forex

Table of Contents

In the vibrant and dynamic world of finance, Malaysian business professionals are increasingly exploring innovative avenues to manage their investments and leverage opportunities in the foreign exchange (Forex) market. Contract for Difference (CFD) trading has emerged as a versatile and valuable instrument for these individuals to participate in Forex trading effectively. CFDs allow Malaysian business personnel to speculate on the price movements of diverse currency pairs without owning the underlying assets. In this article, you will delve into the advantages of forex CFDs in Malaysia, highlighting how it empowers them to achieve their financial goals.

Access to Global Currency Markets

One of the fundamental advantages of CFD trading for Malaysian business professionals is its access to global currency markets. CFDs enable them to trade many major and minor currency pairs worldwide. This access allows Malaysian traders to diversify their Forex portfolios and capitalise on opportunities in international markets. Whether it’s the US Dollar (USD), Euro (EUR), Japanese Yen (JPY), or other currencies, CFDs provide a gateway to the global Forex landscape.

Moreover, the accessibility of global currency markets through CFD trading empowers Malaysian business professionals to stay attuned to global economic developments and geopolitical events that impact currency values. This real-time exposure to international markets allows traders to make informed decisions and adjust their Forex strategies based on a broader understanding of global economic trends and factors influencing currency exchange rates.

Leveraged Trading

CFD trading allows Malaysian business personnel to leverage their capital efficiently. Through leverage, traders can control more prominent positions with a relatively more minor initial investment, known as margin. While leverage amplifies both profits and losses, it allows Malaysian traders to make more substantial trades, potentially enhancing their returns. However, traders need to use leverage prudently and implement risk management strategies.

Hedging against Currency Risk

In international business, managing currency risk is crucial. Malaysian business professionals engaged in international trade can use CFDs as a hedging tool. By taking opposite positions in the Forex market, they can mitigate the impact of adverse currency fluctuations on their business operations. For example, if a Malaysian company exports goods to the United States and expects to receive payments in USD, it can use CFDs to hedge against potential USD depreciation.

Diversification of Portfolios

Diversification is the primitive principle in investment strategy, and CFD trading enables Malaysian business personnel to diforeversify their Forex portfolios effectively. By trading various currency pairs, they can spread risks and reduce exposure to any single currency or market. Diversification helps protect their investments from unexpected market developments and enhances the potential for consistent returns.

Access to Advanced Trading Platforms

CFD brokers offer advanced trading platforms with many tools and features. Malaysian business professionals can benefit from these platforms, which provide real-time market data, technical analysis tools, and customisable trading interfaces. Such features empower multiple traders to make informed decisions, execute precise orders, and stay updated on market developments.

Profit from Both Rising and Falling Markets

One of the distinct advantages of Contract for Difference trading is the ability to profit from both rising and falling markets. Malaysian business personnel can go long (buy) on a currency pair if they anticipate its value will increase or go short (sell) if they expect it to decline. This flexibility allows traders to adapt to changing market conditions and capitalise on opportunities in any market direction.

This unique flexibility in CFD trading is precious for Malaysian business professionals when encountering uncertain market environments or economic uncertainties. Whether facing a bullish or bearish trend, CFDs empower traders to implement diverse trading strategies, such as trend-following or contrarian approaches, depending on their market analysis. This adaptability enables them to navigate volatile markets and potentially profit in various economic scenarios, contributing to their overall trading success and risk management capabilities.

Economic Trading

Compared to traditional Forex trading, CFD trading is economical for Malaysian business professionals. CFD brokers typically offer competitive spreads and low commissions, reducing the overall cost of trading. Additionally, there are no physical delivery costs or currency conversion fees associated with forex CFDs in Malaysia, making them a cost-effective choice for Forex trading.

Risk Management Tools

CFD brokers often provide risk management tools and features that empower Malaysian traders to protect their investments. These tools may include stop-loss orders, take-profit orders, and guaranteed stop-loss orders. These features allow traders to define their risk tolerance and automatically close positions at predetermined price levels, helping to limit potential losses.

Conclusion

Contract for Difference (CFD) trading presents numerous advantages for Malaysian business professionals in the Forex market. These advantages include access to global currency markets, leveraged trading opportunities, effective hedging against currency risk, portfolio diversification, advanced trading platforms, the ability to profit from rising and falling markets, cost-efficient trading, and risk management tools.

CFD trading empowers Malaysian business personnel to make strategic decisions in the Forex market, whether seeking to capitalise on market opportunities, manage currency risk in international business operations, or diversify their investment portfolios. With careful planning, a sound understanding of market dynamics, and prudent risk management strategies, Malaysian business professionals can harness the full potential of CFD trading to achieve their monetary goals and navigate the ever-changing world of Forex trading.

Forex Trading

Top 6 Cryptocurrencies in 2019 That Are Worth GPU Mining

Table of Contents

Many individuals are still interested in mining the various cryptocurrencies that are now available. Things are a little different than one may anticipate when it comes to GPU mining. Although it will take some work on the part of the user to get everything set up correctly, there are still a number of currencies that GPU miners can work on within 2019. It’s also not simple to decide which cryptocurrency to mine because there are businesses like crypto signals that create communities around price speculation.

Dogecoin is Still Viable

Although most people would view Dogecoin as the internet’s funny money, one must remember that it is also a teaching tool. Dogecoin is a very plausible option to consider, especially for those eager to explore the realm of GPU mining. Not just because it has value, but also because it is one of the most accessible currencies today. Although mining is not even necessary to get DOGE, it is a possibility to consider.

As is always the case with mining cryptocurrencies, signing up for a pool is the best course of action. There are still a number of active mining pools available for Dogecoin. Although no one will get wealthy from this specific endeavor, it is a really worthwhile learning experience. In addition, anyone may perform it with any kind of computer, however, the payment will be extremely variable.

Monero is a Solid Option

In the past several years, Monero has grown significantly in popularity among cryptocurrency miners. It illustrates that anyone with a CPU and GPU can mine XMR quite simply, even though that is not usually for the proper reasons. Similar to Dogecoin, it is encouraged to join a Monero mining pool as solo mining may not always provide worthwhile returns. If one is willing to put in some effort, GPU mining is still more than possible even with the currency’s new mining algorithm.

ZenCash Offers Decent Returns

ZenCash is an intriguing choice when it comes to GPU mining, despite the fact that most people tend to ignore cryptocurrencies that are not in the top 25 by market capitalization. 88% of every block reward goes to the miners, which may not be the best percentage. It is one of many Zerocoin-based currencies that can be quickly mined on a standard computer, though. It is a possibility worth considering in 2019 so long as one has the appropriate software and a reputable mining pool.

ZCoin, Not to be Confused with ZCash

The ZCoin currency is a branch of the ZCash project, which some people may already be familiar with. Zcoin is a fascinating choice for individuals who wish to start mining cryptocurrencies. In addition to being traded on the most reputable exchanges, the currency also makes it simple for both new and experienced miners to participate in the activity. If nothing significant changes, ZCoin should continue to be ASIC-proof like Monero, ensuring a lengthy GPU mining life.

Bitcoin Gold Needs More Miners

Bitcoin Gold is a trustworthy alternative for GPU cryptocurrency mining experiments. Although mining Bitcoin itself is still an option, the Bitcoin Gold split may be a superior option for users. Even though the value of this currency has decreased since its introduction, as of this writing, it still has a value of over $24 per BTG. The project team claims that during this year and beyond, there will be some intriguing adjustments and enhancements. What effect that will have on the BTG value is another issue entirely.

CLICK HERE: FOR MORE READING ABOUT UPDATED TIME AND PLEASE FOLLOW ME ON FACEBOOK, TWITTER

Ethereum Attracts a lot of Attention

Everyone can agree that Ethereum is the preferred option when mining cryptocurrencies with a GPU. On paper, it appears to be the most profitable choice, however, there are many miners vying for the block reward on the network. However, with prices rising, it is still a viable alternative for those experienced miners. One drawback is that GPU mining Ethereum may be incredibly expensive because, in today’s world, one graphics card won’t get you very far.

Disclaimer:

This is not investment or trading advice. The aforementioned article is simply meant for reading enjoyment and education. Before buying or investing in any cryptocurrency or digital money, kindly conduct your own research.

Forex Trading

How Will the New B2Trader and B2Core Update Help Brokers?

Table of Contents

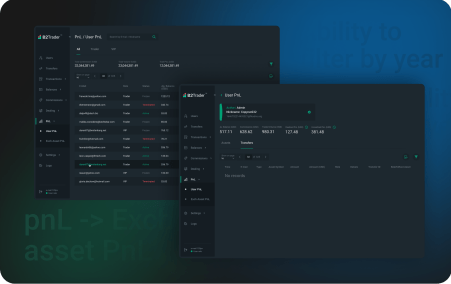

As you are aware, we never provide our customers with inferior instruments for achieving their objectives. We have always endeavored to provide the most cost-effective, safe, and efficient platforms for the fintech industry, and now our B2Broker team is ready to bring some updates to our most sophisticated products, B2Trader and B2Core, in order to better fulfill your requirements. The key features of this edition include a new commission structure, updated user-friendly recommendations, client ID reports, PnL filters, performance and stability adjustments, and a changed user interface.

We hope you enjoy these new features, and we look forward to bringing you many more interesting ones as soon as possible!

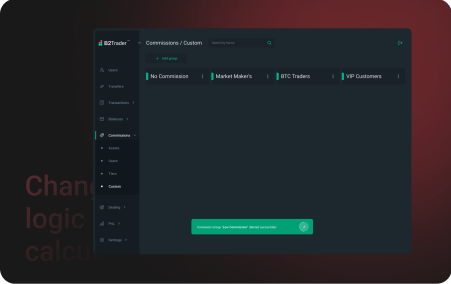

Commissions in a New System

Our organisation is well-versed in fintech and constantly offers the most practical solutions to our clients. This time, we created a new and more accessible option to pay B2Trader commissions at any time and from any location on the planet. We’re introducing a new flexible method that allows you to do more with your time.

Administrators may establish any necessary settings for groups of users, removing the requirement for each user to have their own role. Additionally, each group may choose commissions for certain instruments, making the solution even more user-friendly.

Additional information on the new commission structure may be found in the B2Trader documentation. With B2Trader, you’ll achieve new heights and have the finest trading experience you’ve ever had!

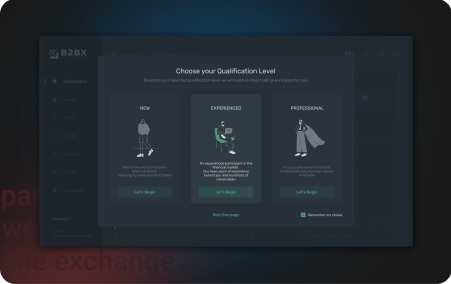

Updated UI— It’s Time for Tips, Don’t Get Lost!

We recognise that navigating the site may be difficult, so we’ve incorporated recommendations to assist you to navigate the UI and make your time on our platform even more enjoyable. It is much easier to comprehend the trading platform’s UI now that all of the components have been provided with important information. Furthermore, we will update the suggestions on a regular basis to ensure that they always reflect the most recent platform adjustments, ensuring that you are not left out of upgrades.

If you’re new to our site and aren’t sure what you should do initially, B2Broker will be your guiding light. We offer qualification levels on the registration page for such scenarios; you may pick whether you are a Beginner, an Experienced, or a Professional. For newcomers, there will be step-by-step guidance on how to use the site, as well as for instructions on how to conduct trades and maintain your account in order to earn your first money.

Advanced users with greater trading and platform expertise will receive more sophisticated scenarios covering topics such as market analysis and risk management. We are certain that by delivering these diverse user experiences, all users will get the most out of our B2BX platform.

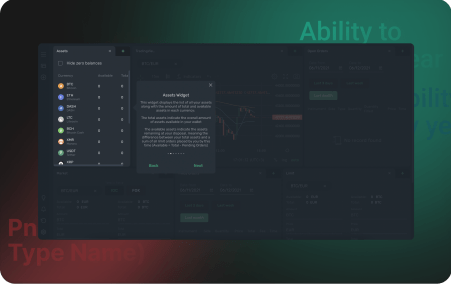

Reports on Client ID

The product team’s efforts to remove manual processes for our clients have paid off with our latest upgrade.

The adoption of unique customer identifiers — client ID — has simplified the process of registering activities for local financial authorities.

These IDs are uploaded to all sites that display the user, including transfers, transaction/trades, transaction/orders, balance/users, and commission/users, along with email addresses.

This streamlines the process and ensures that our clients meet all criteria and regulatory obligations.

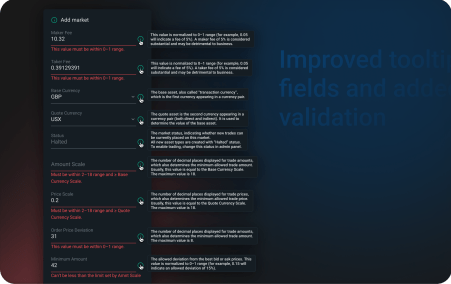

New Pair Field has been added.

We expanded the help sections in the field of establishing a new pair of Settings Markets Add Market + Edit Market to avoid unpleasant experiences. Error notifications have also been added to the sections. Users can now see what should be written in the fields and can no longer save a market that is incorrect. This change will help to ensure that all markets are correctly set up and operate as expected.

Filters have been improved.

We changed the filters so that the PnL column in the admin panel now displays the year the client’s data was last refreshed, making it easier to keep track of changes. This filter is named “by year filter.” Check out the most recent version, which includes a number of new modifications and upgrades aimed at making the platform more user-friendly.

CLICK HERE: FOR MORE READING ABOUT UPDATED TIME AND PLEASE FOLLOW ME ON FACEBOOK, TWITTER

Verdict

As you may have seen, B2Trader and B2Core are two of the most complex platforms available, providing traders with a wide range of tools to provide the best trading experience possible.

Keep an eye out for the forthcoming series of upgrades, which will only strengthen these capabilities more. And now is the greatest time to try out our platforms if you haven’t before! Also, don’t overlook the recently launched payment options; they will undoubtedly help your company.

Forex Trading

Guides to Forex Trading

Forex trading is currently the most lucrative open door, particularly following the 2008 securities exchange crash, in which many people lost their fingers. If you’re new to forex trading, you’re probably thinking about how to get started. In this essay, I discuss the four major forex trading techniques as well as their benefits and drawbacks. Along these lines, let’s get started:

1. Forex Trading Signals

If you are new to forex trading and don’t have a lot of time to learn how to trade, you may invest in a forex signal service. Now, there is a slew of forex signal administrations to choose from. You can receive forex signals via text messages as well as SMS. You don’t have to keep an eye on the market 24 hours a day, 7 days a week with these forex signals. Simply input the trade as instructed by the assistant. The stumbling block is locating a reliable forex signal provider. What’s the best approach to go about it? To begin, use a demo account to test the forex signals. You will only want to know how well the indicators are by trying them on your demo account.

Another step forward has begun right now. A number of seasoned forex traders have started offering signal assistance, in which they swap their own records for cash. As these professional forex merchants make their own exchanging decisions on their live record, you obtain actually live trading recommendations.

Also, you won’t have to continuously visit your MT4 account to enter trade flags since the Trade Copier will do it for you. Obviously, you want to discover a good professional broker who is making a lot of money and is willing to share his live trading account with you via a Trade Copier.

2. Forex Trading Robot

You may also use Forex Robot to develop your own trading programs. Recently, numerous excellent forex robots have been introduced on the market. There are traders who have made a fortune trading forex robots. The problem is that the great majority of them were the ones who designed those robots.

The main issue with these robots is that they must be constantly improved in order to keep up with changing economic conditions. Something that most new dealers are unable to achieve properly since the great majority of them is unfamiliar with forex trading.

Regardless, knowing a little programming is required to be successful with a forex robot. The majority of new brokers believe it is difficult. Forex Robots take care of business, but you’ll need to master both forex trading and MQL4 programming in order to use them. Something that most new dealers find inconvenient.

The vendors will frequently attempt to portray a forex robot as the least difficult forex exchanging arrangement. You just install it on your MT4 platform, and it immediately starts generating revenue for you. Nothing could be further from the truth. Economic conditions are always changing. When the economy changes, a robot that is now operating may begin to lose money.

3. Overseas Foreign Exchange Accounts

Forex Managed Accounts are managed by a knowledgeable forex broker who will exchange your money on your behalf for a fee of 5-20 percent. You retain the right to withdraw your funds at any moment. In reality, you have ultimate control over your funds. Managed forex accounts have long been the preferred method of forex trading for those who lack the time or energy to do so.

CLICK HERE: FOR MORE READING ABOUT UPDATED TIME AND PLEASE FOLLOW ME ON FACEBOOK, TWITTER

4. Forex Trading by Hand

You can, in fact, swap currency and learn how to sell bitcoin on your own. You will, however, need to understand forex trading in order to do so. This could take some time. You’ll also need to put in a lot of practice time to improve your swapping skills. In any case, understanding forex trading is worthwhile. It is, without a doubt, the long-term strategy and should be your ultimate goal.

-

Travel4 years ago

Travel4 years agoThe Family of Kirk Passmore Issues a Statement Regarding the Missing Surfer

-

Technology4 months ago

Technology4 months agoManyroon: The Key to Unlocking Future-Proof Business Solutions

-

Cryptocurrency1 year ago

Cryptocurrency1 year agoBest Tips For Cryptopronetwork com Contact 2024

-

Technology3 years ago

Technology3 years agoPaturnpiketollbyplate Login & Account Complete Guide Paturnpike.com

-

Apps & Software2 years ago

Apps & Software2 years agoFapello 2023: Social Media Platform for NSFW Content

-

Business4 months ago

Business4 months agoCoyyn.com Gig Economy: Smart Contracts and Fair Payments for Freelancers

-

Law3 years ago

Law3 years agoShould I Hire a Lawyer For My Elmiron Case?

-

Business4 months ago

Business4 months agoAcumen: The Key to Smart Decision-Making and Success